U.S. indices hit record highs while Asian stocks react to uncertainty around Trump’s return; Singapore stocks outperform, and China, Vietnam adjust currency rates.

U.S. stock markets surged on Thursday, with the Dow Jones Industrial Average, S&P 500, and Nasdaq all closing at record highs following the U.S. election. The post-election rally was driven by optimism around economic policies and investor sentiment, pushing the indices to new milestones.

In contrast, Asian equities showed mixed performance, as traders digested the potential implications of a possible return of Donald Trump to the White House. Market participants are closely monitoring how Trump’s policies may impact trade, tariffs, and global relations, contributing to market swings in the region.

Singapore’s stock market outperformed its regional peers, buoyed by strong earnings reports and investor confidence. Meanwhile, China and Vietnam took measures to support their economies amid the strengthening U.S. dollar by slashing their respective currency rates. This move aims to counteract the negative impact of a stronger greenback on their exports and trade balances.

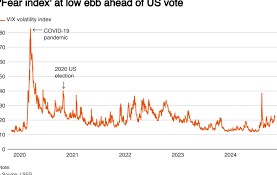

The ongoing shifts in global financial markets highlight the continued uncertainty and volatility, with market participants closely watching developments in U.S. politics and its ripple effects across the globe.

Leave a Reply