Growing acceptance of private assets signals opportunity for credit managers targeting insurers’ portfolios.

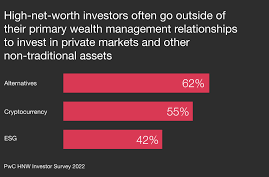

Private credit is making its mark on insurers’ portfolios, with increasing adoption among high-net-worth (HNW) client products. This growing acceptance highlights a shift from traditional public assets, typically seen as safer but now facing volatility and greater correlations. As private assets demonstrate consistent performance, insurers are finding more stability in these investments, especially considering the patient capital they can leverage.

Matthew Michelini, partner and head of Asia-Pacific at Apollo Global Management, explains that many insurers traditionally relied heavily on public assets. However, given the recent volatility in the public markets, private assets, including private credit, are emerging as a more reliable alternative. For private credit managers, this shift presents a valuable opportunity to tap into a market with long-term investment horizons, thanks to the nature of insurers’ capital.

As insurers explore new ways to diversify their portfolios, the increasing integration of private assets, such as credit, reflects a broader trend towards seeking steady returns in a fluctuating economic environment. This transition offers a promising avenue for growth in both the insurance and private credit sectors.

Leave a Reply