New report reveals young adults in their early twenties are struggling more with debt, including credit cards, student loans, and mortgages, than Millennials did a decade ago.

Gen Z, currently aged 22 to 24, is facing a much tougher financial landscape than Millennials did at the same age, according to a recent report from credit bureau TransUnion. Early twentysomethings today are carrying higher levels of debt and experiencing more delinquency across various credit products, from credit cards to mortgages and student loans.

The report found that the average credit card balance for this age group in 2023 was $2,834—26% higher than the balance Millennials had at the same age in 2013, after adjusting for inflation. The financial challenges facing Gen Z are largely attributed to a combination of factors, including the aftermath of a pandemic-induced recession, rising inflation, and record-high rent prices, which have put significant strain on their budgets.

“Overall spending has been strong, and wages aren’t keeping up,” said Charlie Wise, senior vice-president at TransUnion. “Rent is really taking a bite out of their paychecks, and discretionary spending on things like eating out is much higher. And they are relying on credit to cover these costs.”

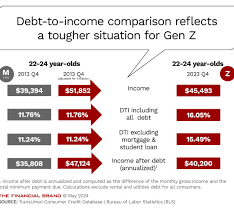

Additionally, Gen Z is earning less than Millennials did at the same stage. In 2023, the average income for people in their early twenties was $45,493, compared to $51,852 for Millennials in 2013 (adjusted for inflation). As a result, they are turning to credit to bridge the gap between rising costs and stagnant wages.

Despite the broader trend of increased credit usage across all age groups, Gen Z stands out for having more lines of credit, higher delinquency rates, and greater debt-to-income ratios than Millennials did. In fact, the average debt-to-income ratio for young adults today is 16%, compared to 12% for Millennials at the same age in 2013.

These financial struggles signal that Gen Z is facing unique challenges that may shape their financial future in ways that differ from the generations before them.

Leave a Reply